Not that simple.

Unless some can afford a place near where they work, they have to live some place where they can afforded to do so. Then if someone did live near where they work, they could be forced to travel future due to the company downsizing, close the doors or relocate to where they now have to drive to. People don't want to up root their children life style and friends so someone can be closer to their work now than before.

I been up rooted a number of times as a child as well doing so with my children beyond my control.

Nothing is easy. I have been moved when I was young and moved during my working career. It is a fact of life for many. I googled out of curiosity and a figure of 11.7 times was quoted for the average American. That seems pretty high but there it is.

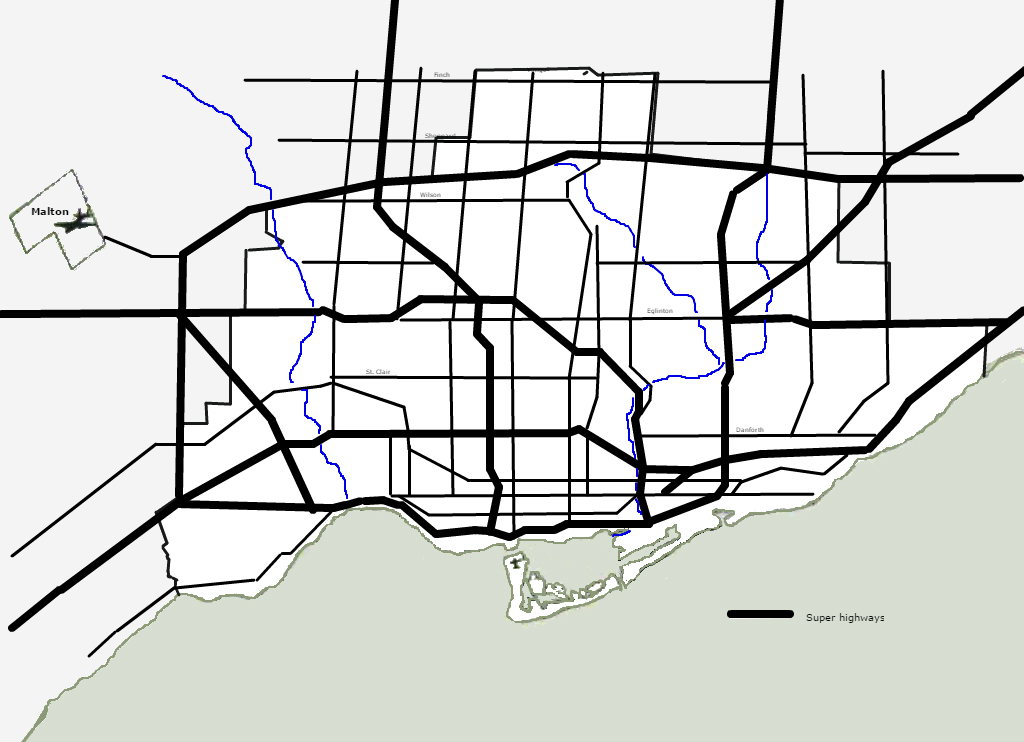

I did say 'better choices'. and making better choices is just not the individuals responsibility, but it is also how we organize our society and our urban areas with better, faster, more connected cities, cities with larger pools of affordable, geared to income housing. Other cities do it, T.O. can too. We talk enough on these forums about better transit, transit that has priority at signals, transit that is separated from car traffic. We do the same with housing, parks, and development in general. But all of this is not overnight change. And probably not achieved perfectly, because perfect is only a state of mind that exists when UT members start drawing lines on maps. But it also starts with accepting that the car is a cost. A transit cost. And a cost to society. So paying a transit fare for car usage recoups some of that cost.

It is also too easy to say, "well our taxes pay for that". Well really not. For instance 2022. Ontario's revenue per capita was the lowest in Canada. And Ontario was one of 5 provinces to record a deficit per capita that year - $422. That does not sound like a lot, but multiply it by the number of people in your household, and the accumulated effect of those deficits is a per capita debt of $19,436, over 100% higher then any other province in Canada. And the interest payment on that was $927 per capita. If the debt was 390 billion or so in 2022, it now lurks around 440 billion and is projected to reach 460 billion in 2026/27. (I also have to check as to whether long term debt of organizations such as Ontario Hydro, around 38 billion, are part of the Provinces financial figures. Some surveys account for this, others do not)

You can make some valid arguments that Ontario's economy is larger and can well support these larger amounts of debt, and the provinces credit rating reflects this. Currently AA You can also make valid arguments that Ontario is spending large amounts of capital to make crucial infrastructure investments for the future (Yes, but no in the case of the SPA, very questionable in the case of the 401 tunnel, rather hopeless in the case of some highway investments to favour his developer legion of supporters, and I am sure there are a few others) And you can make other valid arguments that some of Ontario's costs are not of their doing, for instance extra costs related to the ill conceived Federal Immigration policy of the past few years.

The bottom line is the $ owed. The larger amounts of program $ being spent on interest payments, the larger amount of $ being pushed onto future taxpayers and their taxpaying lives.

We really morph our discussion into tax reform, well it is the season, and the reality of what it costs to live in Ontario, and the fundamental changes that could, or should, or really could ease tax burdens for lower income Ontarians and for those paying taxes long after the rest of us are riding our RIFS into the sunset (Or making substantial profits off of Donald Trump and his coterie of sleazy billionaire advisors).